For many aspiring homeowners in the Houston, TX area, the biggest hurdle standing between renting and owning is the down payment. While traditional wisdom suggests you need 20% down to buy a home, the modern mortgage landscape offers incredible alternatives. One of the most powerful—yet often misunderstood—options is the USDA Loan.

For many aspiring homeowners in the Houston, TX area, the biggest hurdle standing between renting and owning is the down payment. While traditional wisdom suggests you need 20% down to buy a home, the modern mortgage landscape offers incredible alternatives. One of the most powerful—yet often misunderstood—options is the USDA Loan.

At Peyton Mortgage, we find that many clients assume “USDA” implies buying a working farm or moving hours away from civilization. The reality is quite different. The USDA Rural Development Loan is designed to boost homeownership in suburban and rural areas, many of which are just a short drive from downtown Houston.

If you are looking for a zero-down payment mortgage with competitive interest rates, understanding USDA eligibility is your first step. In this comprehensive guide, Roger Young and the team at Peyton Mortgage will break down exactly what a USDA loan is, how the eligibility map works in Texas, and why this might be the perfect loan program for your family.

What Is a USDA Loan?

A USDA loan is a mortgage backed by the U.S. Department of Agriculture (USDA) as part of its Rural Development Guaranteed Housing Loan program. The government created this program to promote economic development and improve the quality of life in rural areas.

Because the government guarantees a portion of the loan, lenders like Peyton Mortgage can offer more favorable terms to borrowers who might not qualify for conventional financing. The most significant advantage? It allows for 100% financing, meaning no down payment is required.

While the program is labeled “rural,” the definition of rural is based on population density. This means many small towns, suburbs, and developing communities on the outskirts of major metropolitan areas like Houston often qualify.

The Top Benefits of Choosing a USDA Loan

Why should you consider a USDA loan over an FHA or Conventional loan? Here are the primary benefits that make this program a favorite among first-time homebuyers in Texas:

1. Zero Down Payment (100% Financing)

This is the headline feature. Unlike Conventional loans (which typically require 3-5% down) or FHA loans (which require 3.5% down), a USDA loan allows you to finance 100% of the home’s purchase price. For a $300,000 home, this saves you from having to scrape together $10,500 to $15,000 in cash upfront.

2. Lower Mortgage Insurance Costs

Most loans with less than 20% down require Private Mortgage Insurance (PMI). USDA loans have a guarantee fee (similar to PMI), but it is significantly lower than the monthly mortgage insurance premiums found on FHA loans. This keeps your monthly payment more affordable.

3. Competitive Interest Rates

Because these loans are government-backed, they present less risk to lenders. Consequently, USDA interest rates are often some of the lowest available on the market, helping you save thousands of dollars over the life of your loan.

4. Flexible Credit Requirements

While credit requirements vary by lender, the USDA program is generally more forgiving than conventional lending standards. It is designed to help low-to-moderate-income families achieve the American dream.

Am I Eligible? Understanding the Requirements

To qualify for a USDA loan, you must meet specific criteria regarding the property location, your income, and your credit history. Let’s break these down.

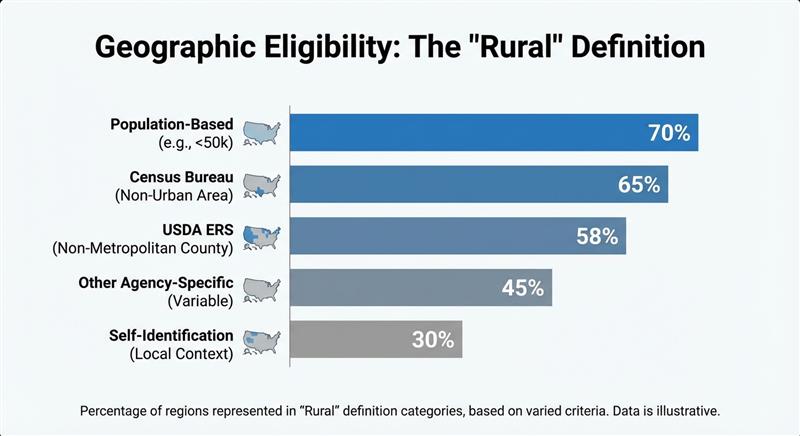

1. Geographic Eligibility: The “Rural” Definition

The property must be located in a USDA-eligible area. In the context of Houston, TX, the city center and densely populated inner suburbs are excluded. However, once you move outside the major beltways, eligibility opens up.

Many areas in counties surrounding Harris County—such as parts of Montgomery, Liberty, Waller, and Fort Bend counties—are often eligible. If you are looking at homes in growing communities that still have a “small town” feel but are commutable to Houston, there is a high probability the property qualifies.

Note: You can verify a specific address using the USDA property eligibility map, or simply contact Roger Young at Peyton Mortgage, and we can check the address for you instantly.

2. Income Limits

USDA loans are designed for low-to-moderate-income households. To be eligible, your total household income cannot exceed 115% of the median household income for the area in which you are buying. These limits vary by county and household size.

- Adjusted Income: The USDA looks at your adjusted gross income, meaning you can deduct certain expenses (like childcare or elderly care) to help you qualify under the limit.

- Household Calculation: It is important to note that the income of everyone living in the house (even if they aren’t on the loan) counts toward the income cap.

3. Credit and Employment

While there is no fixed minimum credit score set by the USDA, most lenders look for a score of 640 or higher to use the USDA’s automated underwriting system. If your score is lower, manual underwriting might be an option, though it requires stricter debt-to-income ratios.

You must also demonstrate a stable employment history, typically showing two years of consistent income.

Loan Comparison: USDA vs. FHA vs. Conventional

Choosing the right mortgage can be confusing. Here is a quick comparison to help you see how USDA loans stack up against other popular options available at Peyton Mortgage.

| Feature | USDA Loan | FHA Loan | Conventional Loan |

|---|---|---|---|

| Down Payment | 0% (None required) | 3.5% | 3% – 20% |

| Mortgage Insurance | Low monthly fee + Upfront fee (can be financed) | Higher monthly MIP + Upfront MIP | PMI required if under 20% down (rates vary by credit) |

| Location Restriction | Yes (Must be in eligible area) | No restrictions | No restrictions |

| Income Limits | Yes (Max income caps apply) | No income limits | No income limits |

| Target Borrower | Low-to-moderate income in rural/suburban areas | Borrowers with lower credit or higher debt | Borrowers with good credit and savings |

The USDA Loan Process with Peyton Mortgage

Navigating government-backed loans requires attention to detail. At Peyton Mortgage, Roger Young and the team guide you through every step to ensure a smooth closing.

- Pre-Qualification: Contact us to review your income and credit. We will determine if you meet the income caps and credit requirements.

- Property Search: Once pre-qualified, you can start house hunting! We will provide you with a map or list of eligible areas around Houston so you don’t waste time looking at ineligible homes.

- Make an Offer: When you find the perfect home, you make an offer. Be sure to include a financing contingency for a USDA loan.

- Processing & Underwriting: Once your offer is accepted, we gather your documents (W2s, bank statements) and submit the file to the underwriter.

- USDA Final Approval: Unlike other loans, USDA loans go through a two-step approval: first by the lender, and finally by the USDA office itself.

- Closing: Once the USDA issues their commitment, you sign the papers and get the keys to your new home!

Common Misconceptions About Rural Housing Loans

Don’t let myths stop you from applying. Here are a few clarifications regarding USDA loans:

- Myth: “I have to buy a farm.”

Fact: You actually cannot buy an income-producing farm with a standard residential USDA loan. It is for single-family homes. - Myth: “The homes are run-down.”

Fact: USDA requires the home to be safe, sanitary, and sound. You can buy a brand-new construction home or a well-maintained existing home. - Myth: “It takes forever to close.”

Fact: While the extra step of USDA government review adds a few days, an experienced lender like Peyton Mortgage knows how to manage the timeline effectively for a timely closing.

Frequently Asked Questions (FAQs)

1. Can I use a USDA loan to build a new home?

Yes, there are USDA construction-to-permanent loans available that allow you to finance the construction of a new home and the land purchase in a single closing. However, these are more specialized. Contact us to discuss new construction options.

2. Are there loan limits on how much I can borrow?

Unlike FHA or Conventional loans, the USDA does not have a fixed maximum loan amount. Instead, your loan limit is determined by your debt-to-income ratio and your ability to repay the mortgage based on your household income.

3. Can I have a swimming pool with a USDA loan?

This is a common question in Texas! Previously, USDA had strict rules against financing value attributed to in-ground pools. However, guidelines have relaxed. You can buy a home with a pool, but the appraiser must ensure the pool is functional and safe. Always check with your lender for the most current guidelines.

4. What happens if my income increases after I get the loan?

The income limits apply only at the time of closing. If you get a raise or a better job a year after you buy the house, you do not lose your loan, and your terms do not change.

5. Can I refinance a USDA loan later?

Yes! The USDA offers a “Streamline Refinance” program that allows existing USDA borrowers to refinance into a lower interest rate with reduced paperwork and often without a new appraisal.

Ready to Explore Your Home Buying Options?

If you are tired of renting and want to see if you qualify for a zero-down payment home loan in the Greater Houston area, Peyton Mortgage is here to help. We specialize in helping Texas families navigate the USDA eligibility map and secure the financing they need.

Don’t assume you can’t buy a home just because you haven’t saved a 20% down payment. The USDA loan might be the solution you have been looking for.