For veterans, active-duty service members, and surviving spouses in Houston, TX, and across the nation, the VA home loan is widely considered the most powerful mortgage product on the market. With benefits like $0 down payment, no private mortgage insurance (PMI), and competitive interest rates, it is a well-deserved benefit for those who have served our country.

For veterans, active-duty service members, and surviving spouses in Houston, TX, and across the nation, the VA home loan is widely considered the most powerful mortgage product on the market. With benefits like $0 down payment, no private mortgage insurance (PMI), and competitive interest rates, it is a well-deserved benefit for those who have served our country.

However, navigating the eligibility requirements can sometimes feel as complex as a military operation. You might be asking, “How do I know if I actually qualify?” or “Is my credit score high enough for a Texas VA loan?”

At Peyton Mortgage, we specialize in helping Houston veterans unlock the doors to homeownership. We can even help with credit scores as low as 550 for VA home or FHA loans. In this comprehensive guide, we will break down the service requirements, financial benchmarks, and property standards you need to meet to secure a VA loan.

The Three Pillars of VA Loan Qualification

To determine if you qualify, you need to look at three distinct categories. Think of these as a three-legged stool; all three must be stable for the loan to be approved:

- Service Eligibility: Your time in the

- Financial Eligibility: Your income, credit, and

- Property Eligibility: The condition and type of home you are

Let’s dive deep into each category so you can move forward with confidence.

1. Service Eligibility: Did You Serve Enough Time?

The first step is establishing that you have served the minimum required time to earn the benefit. The Department of Veterans Affairs sets specific timeframes depending on when you served and whether it was during wartime or peacetime.

Generally, you may be eligible for a VA Home Loan if you meet one of the following criteria:

- You have served 90 consecutive days of active service during

- You have served 181 days of active service during

- You have served 6 years in the National Guard or

- You are the spouse of a service member who died in the line of duty or as a result of a service-connected disability.

Service Duration Requirements Table

To make it easier to visualize, refer to the table below regarding service eras:

Service Era Dates Minimum Service Requirement Gulf War (Present) Aug. 2, 1990 – Present 24 continuous months or the full period (at least 90 days) for which you were called to active duty. Vietnam Era Aug. 5, 1964 – May 7, 1975 90 total days. Korean Conflict June 27, 1950 – Jan. 31,

1955 90 total days. World War II Sept. 16, 1940 – July 25, 1947 90 total days. Peacetime Periods

1947–1950, 1955–1964, 1975–1980 181 continuous days. Separated from Service Any Era If you were discharged for a hardship, government convenience, reduction in force, or service-connected disability, time requirements may be waived.

The Golden Ticket: Your Certificate of Eligibility (COE)

Meeting the time requirements is the theory; the Certificate of Eligibility (COE) is the proof. This is the official document from the VA that tells a lender, “Yes, this person is eligible for a VA loan.”

How do you get it?

- Apply via the VA eBenefits Portal: You can log in and request it

- Mail in Form 26-1880: This is the slower, manual

- Let Peyton Mortgage Handle It: As an approved lender, we can often pull your COE instantly through our internal If you are struggling to find your paperwork, contact us today, and we can help you obtain it.

2. Financial Eligibility: Credit and Income

Just because you have a COE doesn’t automatically mean you get a loan. You still must demonstrate to the lender that you can repay the mortgage. However, VA loans are generally more flexible than Conventional loans.

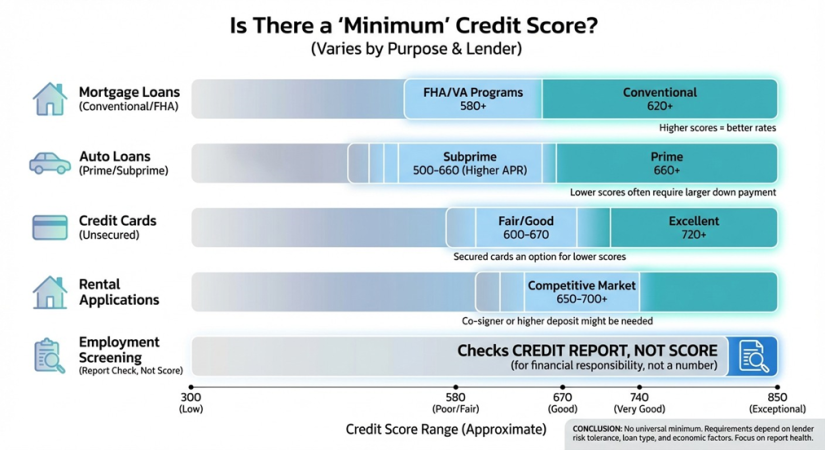

Is There a Minimum Credit Score?

Technically, the VA does not set a minimum credit score requirement. However, lenders (banks and mortgage brokers) have their own “overlays.”

In the current market, most lenders look for a credit score of 580 to 620 or higher. If your score is on the lower end, don’t panic. VA loans are much more forgiving regarding past credit events, such as bankruptcies or foreclosures, compared to other loan programs. The waiting periods after these events are significantly shorter for VA borrowers.

Debt-to-Income (DTI) Ratio

Your Debt-to-Income (DTI) ratio compares your monthly debt payments (credit cards, car loans, student loans) to your gross monthly income. The VA generally prefers a DTI of 41% or lower.

However, this is not a hard cap. If you have a higher DTI, you can still qualify if you have strong Residual Income.

The Secret Weapon: Residual Income

If your DTI is high, but your residual income exceeds the VA guidelines for your family size and region (Houston is in the South region), you can often still get approved. This common-sense approach to underwriting is why the VA loan is so powerful.

3. Property Eligibility: The “MPRs”

The VA guarantees loans for primary residences only. You cannot use a VA loan to buy a vacation home in the Hill Country or an investment rental property (unless you plan to live in one of the units of a multi-family property).

The home you buy in Houston or surrounding areas must meet the VA’s Minimum Property Requirements (MPRs). The appraiser will check to ensure the home is:

- Safe: No exposed wiring, dangerous steps, or structural

- Sanitary: Clean water supply, functioning sewage system, and no pest infestations (termites are a big check in Texas).

- Structurally Sound: The roof must have life left in it, and the foundation must be

If you are looking at a “fixer-upper,” a standard VA loan might be tricky unless the seller agrees to repairs before closing. However, for most move-in ready homes in the Houston market, passing the MPR check is straightforward.

Why Work with a Local Houston VA Expert?

At Peyton Mortgage, led by Roger Young, we understand the nuances of the local market. Whether you are looking in Memorial, Katy, Cypress, or right here in the heart of Houston, we provide personalized service that treats you like a neighbor, not a number.

- Local Knowledge: We know the Texas veteran land board programs and local property tax

- Speed: In a competitive market, you need a lender who answers the phone and moves

- Full Suite of Options: If for some reason you don’t qualify for a VA loan, we can seamlessly compare FHA, USDA, and Conventional options to find the right fit.

Frequently Asked Questions (FAQs)

1. Can I get a VA loan if I have already used one before?

Yes! The VA loan is not a one-time benefit. You can reuse your entitlement. If you paid off your previous VA loan and sold the house, your full entitlement is restored. Even if you still own the first home, you may have “bonus entitlement” remaining to buy a second primary residence when you move.

2. Do I need money for closing costs if the down payment is $0?

Yes, there are still closing costs (title fees, appraisal, taxes, insurance). However, the VA allows sellers to pay up to 4% of the purchase price toward your closing costs and debts. We can help structure your offer to minimize your out-of-pocket expenses.

3. What is the VA Funding Fee?

The VA Funding Fee is a one-time fee paid to the VA to help keep the program running for future generations. It ranges from 2.15% to 3.3% of the loan amount for first-time and repeat users.

Important: If you receive VA disability compensation for a service-connected disability, this fee is waived entirely.

4. Can I use a VA loan to buy a condo in Houston?

Yes, but the condominium complex must be on the VA-approved list. If you find a condo you love that isn’t on the list, Peyton Mortgage can sometimes help with the approval process, though it takes extra time.

5. How long does the pre-approval process take?

With Peyton Mortgage, we can often get you pre-approved within 24 hours once we have your basic documentation (COE, income proof, and credit check). We know that in the Houston market, speed wins offers.

Ready to Claim Your Benefit?

You served your country; now let us serve you. Determining your qualification is the first step toward building wealth through real estate. Don’t let confusion about credit scores or service time stop you from exploring your options.

Contact Peyton Mortgage today for a free, no-obligation consultation. We will pull your Certificate of Eligibility, review your financial picture, and get you ready to house hunt in Houston with confidence.