Expert insights from Roger Young and the Peyton Mortgage Team in Houston, TX.

Expert insights from Roger Young and the Peyton Mortgage Team in Houston, TX.1. Assessing Your Financial Foundation

Before browsing listings in Memorial or the greater Houston area, you must understand your starting point. A proactive approach now leads to smoother transactions later.

Review Your Credit Profile Early

Your credit score remains one of the most significant factors in determining your mortgage interest rate and loan eligibility. As we advise all our clients, do not wait until you find the perfect home to check your credit. Start 2026 by reviewing your report for errors and paying down high-balance revolving accounts. Small improvements here can save you thousands of dollars over the life of a loan.

Define Your “Why”

Are you buying to stop renting? Are you refinancing to consolidate high-interest debt? Or are you investing for future wealth? Defining your goal helps us, as your trusted mortgage professionals, recommend the right product—whether that is an FHA loan, a Conventional mortgage, or a VA loan.

2. Buying Strategies for the 2026 Houston Market

The Houston real estate market is dynamic. To navigate it successfully in 2026, you need to match your financial profile with the right loan program.

For First-Time Homebuyers: FHA and Conventional Options

Entering the market for the first time can be intimidating, but it is also the best way to start building generational wealth. We specialize in helping first-time buyers navigate the complexities of the process.

- FHA Loans: These are fantastic for buyers who may have lower credit scores or smaller down payments. The Federal Housing Administration insures these loans, allowing lenders like Peyton Mortgage to offer more flexible qualification terms.

- Conventional Loans: For those with stronger credit profiles, conventional financing often offers competitive rates and fewer mortgage insurance requirements once you reach 20% equity.

For Our Heroes: VA Loans

Texas is home to a massive community of veterans, and serving those who served is a core part of our mission. If you are an eligible veteran or active-duty service member, the VA Loan is arguably the best mortgage product available. It typically requires $0 down payment and no monthly mortgage insurance (PMI). In a market like Houston, keeping your cash reserves liquid while securing a home is a powerful wealth-building strategy.

Local Insight: The Houston Advantage

Unlike many coastal markets, Houston continues to offer pockets of affordability. Whether you are looking near Memorial Drive or expanding into the suburbs, our team offers local expertise that nationwide call centers simply cannot match. We know the area, we know the appraisers, and we know how to get offers accepted.

3. Strategic Refinancing: More Than Just Rate Drops

Many homeowners view refinancing solely as a tool to lower their interest rate. While that is a valid reason, a Cash-Out Refinance can be a sophisticated financial tool in 2026.

Debt Consolidation

With consumer credit card debt rising, many homeowners are sitting on significant equity while paying double-digit interest rates on credit cards. By refinancing, you can use your home’s equity to pay off high-interest debt, consolidating it into one tax-deductible (consult your tax advisor) mortgage payment with a much lower interest rate. This improves monthly cash flow and financial stability.

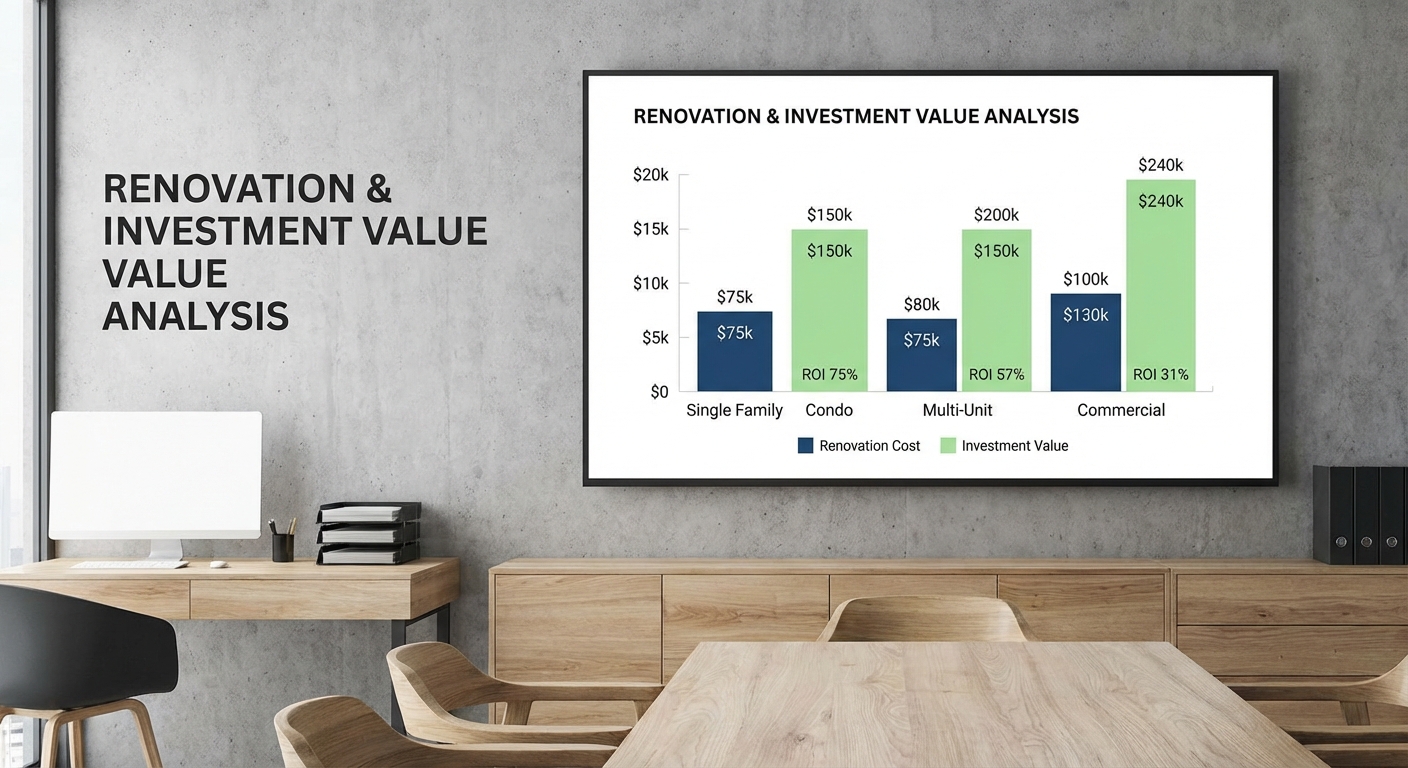

Renovation and Investment

If you are considering this, visit our Refinance page to explore your scenarios.

If you are considering this, visit our Refinance page to explore your scenarios.

Loan Program Comparison Table

Choosing the right loan is critical. Here is a quick comparison of the primary loan types we offer at Peyton Mortgage to help you visualize your 2026 roadmap.

| Loan Program | Ideal For | Down Payment | Key Benefit |

|---|---|---|---|

| Conventional | Borrowers with good credit (620+) | As low as 3% – 5% | No PMI with 20% equity; flexible terms. |

| FHA Loan | First-time buyers; Lower credit scores | 3.5% | Easier qualification; flexible debt-to-income ratios. |

| VA Loan | Veterans & Active Duty | 0% | No Down Payment; No Monthly PMI; Competitive Rates. |

| Cash-Out Refinance | Homeowners with equity | N/A (Uses Equity) | Consolidate high-interest debt or fund renovations. |

The Peyton Mortgage Difference

In an era of automated approvals and impersonal apps, Peyton Mortgage stands apart. We are committed to providing our clients with the highest quality financial services combined with the lowest rates available in your area.

Why work with Roger Young and the team?

- Personalized Service: We work with you one-on-one. You are not just a loan number; you are a neighbor in the Houston community.

- Privacy & Security: Unlike many larger nationwide mortgage companies, all your information is kept secure and private.

- Tailored Solutions: Whether purchasing your dream home or consolidating debt, we find the loan program that fits your needs, not our sales quotas.

Our ultimate goal is to create lasting relationships. We want to be your mortgage advisor for life, from your first starter home to your eventual retirement downsize.

Frequently Asked Questions (FAQs)

1. Is 2026 a good year to buy a home in Houston?

2. How much down payment do I really need?

Many buyers believe they need 20% down, but that is a myth. Qualified buyers can purchase with as little as 3% (Conventional) or 3.5% (FHA). Veterans often qualify for 0% down. We can help you determine the best entry point based on your savings.

3. Can I refinance if I have bad credit?

It depends on the severity of the credit issues and the amount of equity you have. FHA refinances can be more forgiving regarding credit scores. The best approach is to contact us for a review of your specific situation.

4. What is the difference between a Mortgage Broker and a Bank?

As a mortgage broker, Peyton Mortgage has access to multiple wholesale lenders. This allows us to “shop” the market for you to find the lowest rates and best terms, whereas a bank can typically only offer their own specific products.

5. How long does the pre-approval process take?

With Peyton Mortgage, the process is streamlined. Once we have your application and documents, we can often provide a pre-approval letter very quickly, giving you the confidence to make offers on homes immediately.

Take the Next Step in Your Homeownership Journey

Don’t leave your 2026 financial goals to chance. Whether you are ready to buy, looking to lower your monthly payments, or simply have questions about your borrowing power, Roger Young and the Peyton Mortgage team are here to help.

Contact us today to start your personalized roadmap.

Phone: 1-346-570-0846

Email: roger@peytonmortgage.com

Website: www.peytonmortgage.com