By Roger Young, Peyton Financial Mortgage | Houston, TX | roger@peytonmortgage.com | 346-570-0846

Introduction

As we approach 2026, the mortgage industry is abuzz with optimism. The elusive “mortgage sweet spot” seems to be within reach for the first time in years. Mortgage rates are finally cooperating, providing potential homeowners and investors with a rare opportunity to secure favorable terms. In this comprehensive guide, we’ll explore why mortgage rates are aligning favorably, how you can take advantage of them, and why acting now is crucial before the window closes.

For residents of Houston, TX, this is particularly pertinent. The local housing market, combined with these favorable rates, makes it an opportune moment to consider a home purchase or refinance. Let’s delve into the details.

Understanding the Current Mortgage Landscape

The mortgage landscape has been through significant fluctuations over the past decade. From the financial crisis of 2008 to the pandemic-induced economic shifts, rates have seen highs and lows. As we step into 2026, several factors are contributing to a more stable and favorable mortgage rate environment:

- Economic Recovery: The global economy is on a steady recovery path post-pandemic, leading to increased consumer confidence and stability in financial markets.

- Federal Reserve Policies: The Federal Reserve’s cautious approach to interest rate hikes has played a key role in maintaining low mortgage rates.

- Inflation Control: Efforts to keep inflation in check have been largely successful, preventing abrupt rate increases.

- Technological Advancements: The mortgage industry has embraced technology, making the process more efficient and less costly, which has indirectly influenced rate stability.

Why 2026 is the Year of the Mortgage Sweet Spot

Several unique aspects make 2026 a standout year for securing a mortgage. Understanding these can help you make informed decisions:

1. Historical Rate Comparisons

To grasp the significance of current rates, let’s compare them to historical data:

| Year |

Average Mortgage Rate (%) |

| 2016 |

3.65 |

| 2023 |

4.94 |

| 2026 |

3.15 |

As shown, 2026 offers some of the lowest rates seen in a decade, making it an ideal time for new mortgages or refinancing.

2. Local Market Dynamics in Houston

Houston’s real estate market is thriving, with a steady influx of new residents and businesses. The demand for housing is on the rise, and current mortgage rates provide a perfect opportunity to tap into this vibrant market. Whether you’re a first-time buyer or looking to upgrade, now is the time to act.

3. Advantages of Locking In Rates Now

Locking in a low rate now can protect you from potential future increases. Here’s why it’s beneficial:

- Cost Savings: Lower rates mean lower monthly payments, potentially saving you thousands over the life of the loan.

- Investment Security: Fixed rates offer certainty, making it easier to budget and plan long-term financial goals.

- Competitive Edge: Acting quickly can give you an edge in a competitive housing market, especially in high-demand areas like Houston.

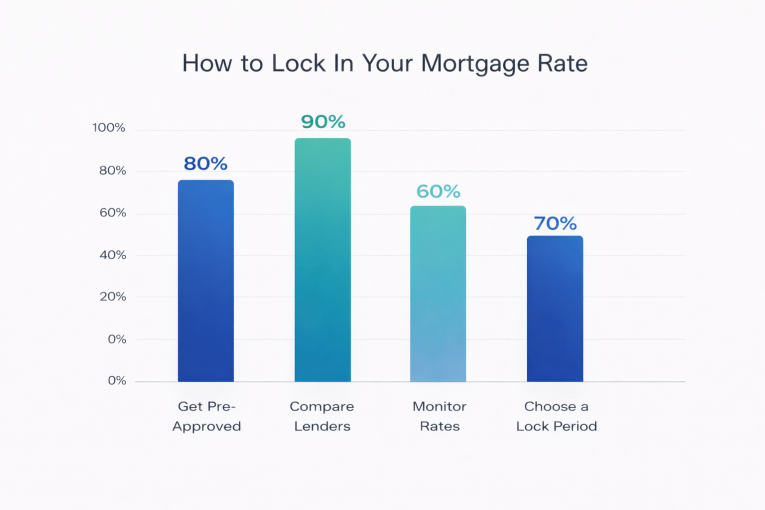

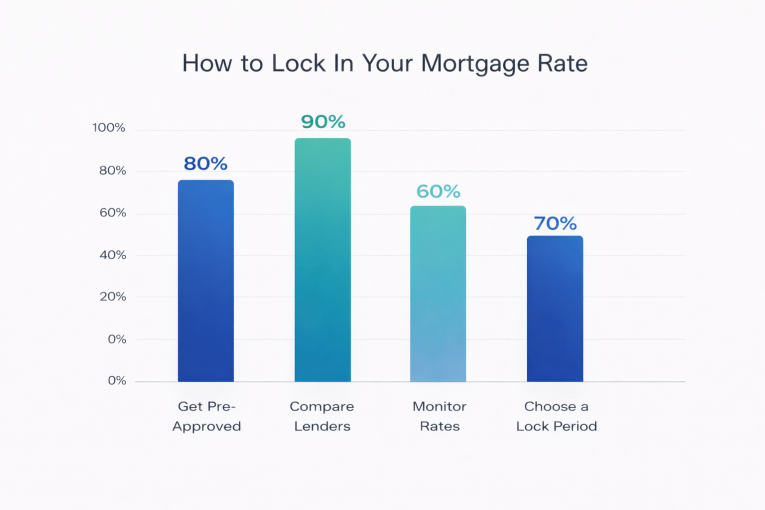

How to Lock In Your Mortgage Rate

1. Evaluate Your Financial Health

Before applying for a mortgage, assess your financial situation. Check your credit score, clear outstanding debts, and ensure you have a stable income source. A strong financial profile can help you secure better terms.

2. Shop Around for Lenders

- Interest rates

- Loan terms

- Closing costs

- Customer service reviews

At Peyton Financial Mortgage, we provide competitive rates and personalized service to help you find the best mortgage solution in Houston.

3. Consider Different Mortgage Options

Explore various mortgage products to find one that aligns with your financial goals. Common options include:

- Fixed-Rate Mortgages: Offers consistent payments throughout the loan term.

- Adjustable-Rate Mortgages (ARMs): Initially lower rates that adjust over time.

- Jumbo Loans: For higher-priced properties, common in upscale Houston neighborhoods.

4. Get Pre-Approved

5. Lock in Your Rate

Once you’ve found the right lender and mortgage product, lock in your rate. This ensures your rate is secured, protecting you from future increases as you move forward with your home purchase.

FAQs

1. What is a mortgage rate lock?

A mortgage rate lock is an agreement between you and your lender that ensures your interest rate won’t change between the offer and closing, as long as you close within the specified time frame.

2. How long can I lock in a mortgage rate?

Rate locks typically last from 30 to 60 days. However, some lenders offer longer lock periods, though this may come with additional costs.

3. Can I change my lender after locking in a rate?

Yes, you can switch lenders after locking in a rate, but be aware that you may lose the locked rate and incur additional costs.

4. What happens if rates go down after I lock in?

If rates decrease after you lock in, some lenders offer a float-down option for a fee, allowing you to benefit from the lower rate.

5. Why is it important to lock in a rate now?

Locking in a rate now protects you from potential rate increases in the future, ensuring your mortgage payments remain manageable.

Conclusion

The year 2026 presents a rare and favorable opportunity for those seeking to secure a mortgage in Houston. With historically low rates and a thriving real estate market, now is the time to act. At Peyton Financial Mortgage, we’re here to guide you through this process, offering expert advice and competitive rates to help you achieve your homeownership dreams.

Contact Us: Ready to take the next step? Contact us today or call 346-570-0846 to speak with one of our mortgage experts.

Pre-approval is often treated as the green light to shop at the top of a budget. However, the most successful buyers begin with a deeper conversation about comfort, lifestyle, and risk tolerance. A lender can determine what is possible, but only the buyer can determine what feels sustainable. Aligning personal comfort with financial approval creates long term stability.

Pre-approval is often treated as the green light to shop at the top of a budget. However, the most successful buyers begin with a deeper conversation about comfort, lifestyle, and risk tolerance. A lender can determine what is possible, but only the buyer can determine what feels sustainable. Aligning personal comfort with financial approval creates long term stability.